ODFL Payroll and How to Access It

Old Dominion Freight Line (ODFL) is a leading transportation company in the U.S., and it places a strong emphasis on ensuring its employees are paid accurately and on time. As part of their commitment to employee satisfaction, ODFL provides a comprehensive payroll system that allows employees to easily access their pay information and manage their earnings. Understanding ODFL’s payroll system and how to access it is crucial for employees to stay on top of their finances and ensure that their hard work is rewarded.

Understanding ODFL Payroll System

ODFL’s payroll system is designed to be efficient, transparent, and reliable. Employees are paid on a regular schedule, whether weekly, biweekly, or monthly, depending on their role within the company. The company ensures that all wages are processed accurately, including deductions for taxes, insurance, retirement contributions, and other withholdings.

In addition to base pay, ODFL employees may receive performance-based bonuses, safety incentives, and other allowances depending on their job performance and the company’s incentive programs. For example, drivers often receive bonuses based on their driving safety record, and employees in other roles may receive incentives for meeting operational goals.

Employees can access detailed information about their earnings, deductions, and other payroll-related data. Pay stubs are provided digitally and can be reviewed at any time to help employees track their earnings and financial activities.

Key Features of ODFL Payroll

Here are some of it Payroll features, you may also explore all Odfl4us employee benefits as well.

Direct Deposit: ODFL offers direct deposit to ensure that employees’ wages are deposited into their bank accounts on payday. This eliminates the need for paper checks and ensures that employees have quick and secure access to their earnings. Employees can choose their preferred bank account for direct deposit, and the system allows for multiple deposit accounts if needed.

Pay Stubs: Employees can view and download detailed pay stubs through ODFL’s online payroll portal. The pay stubs display a breakdown of gross pay, taxes, benefits deductions, and net pay, allowing employees to monitor their earnings and understand how their pay is calculated.

Payroll Deductions: The payroll system automatically deducts applicable amounts for federal and state taxes, social security, healthcare premiums, retirement plan contributions, and other benefits. This ensures that employees comply with tax requirements and benefit contributions without needing to manually process these deductions.

Accessing Payroll Information: ODFL provides an online portal where employees can securely log in to access their payroll information. This portal allows employees to view their pay stubs, track hours worked, and make updates to their payment preferences (such as changing bank account information for direct deposit).

Payroll Support: ODFL’s payroll system is backed by a dedicated support team to help employees with any payroll-related issues, such as discrepancies in pay, tax inquiries, or questions about deductions. Employees can contact the payroll department directly for assistance.

How to Access ODFL4US Payroll

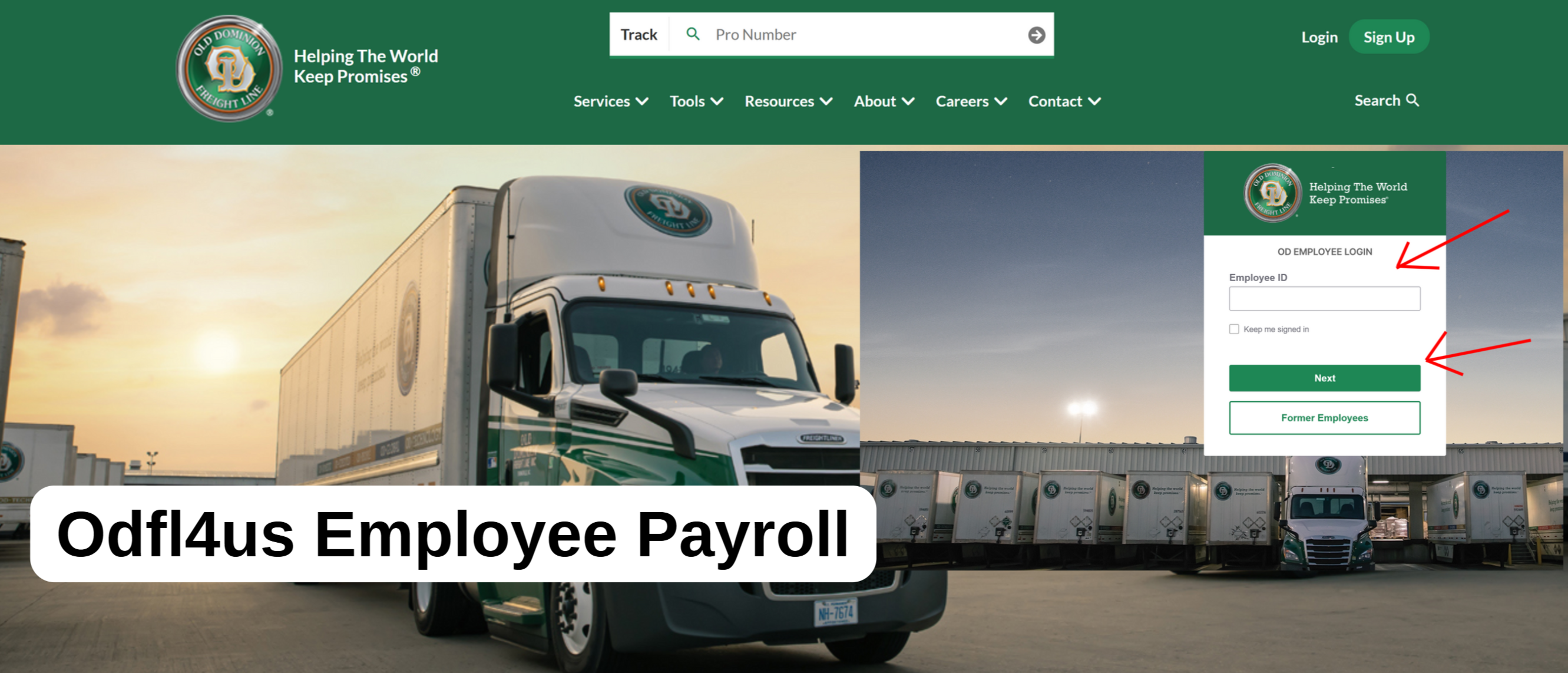

To access ODFL payroll, employees need to use the ODFL4US Employee Login portal, which is the designated online platform for ODFL employees. Here’s a step-by-step guide to accessing your payroll information;

1. Visit the ODFL Employee Login Portal: To begin, employees need to copy the URL for ODFL4US login and open on your browser: https://odfl4us.com

2. Log in with Your Credentials: Once on the portal, employees will be prompted to enter their unique employee ID and password. If it is your first time logging in, you may be asked to create an account or verify your identity. Make sure to keep your login credentials secure.

3. Navigate to the Payroll Section: After logging in, navigate to the payroll or pay stub section. This section typically provides access to your pay history, current pay stubs, and any other relevant payroll information.

4. View or Download Pay Stubs: In the payroll section, employees can view a detailed breakdown of their earnings, deductions, and net pay for each pay period. Pay stubs can often be downloaded or printed for personal records or tax purposes.

5. Update Payment Information (If Necessary): Employees can also update their direct deposit information, personal details, or tax withholding preferences through the portal. This ensures that employees’ payroll information is always up-to-date and accurate.

For ODFL Employee Support?

Contact Payroll Support (If Needed): If there are any discrepancies or issues with the payroll information, employees can contact the payroll support team through the portal or via Odfl4us contact page for details. ODFL’s payroll department is available to resolve issues promptly.

Conclusion

ODFL’s payroll system is designed to make the process of earning, tracking, and managing wages as seamless and transparent as possible for employees. By offering direct deposit, detailed pay stubs, and secure access to payroll information, the company ensures that employees are paid accurately and on time.

The online portal is a convenient way for employees to access their pay information, track deductions, and resolve any issues that may arise. Understanding how to navigate the payroll system is key to managing your finances effectively while working at ODFL.